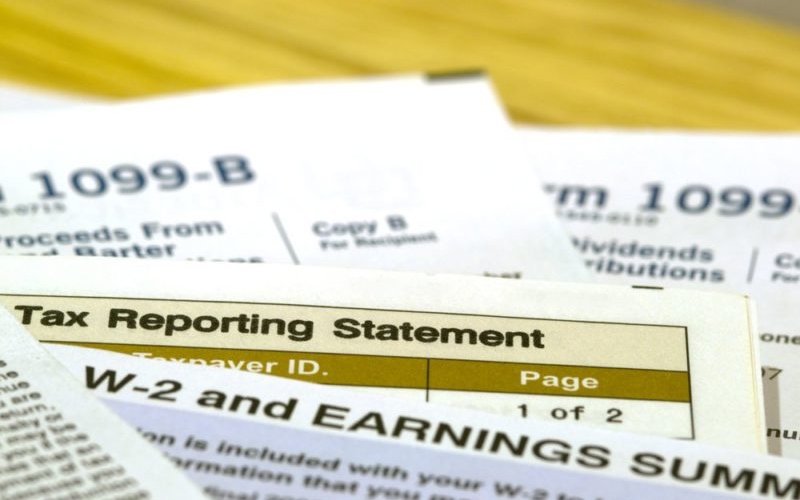

Before filling out the 1099 reporting form there are certain things a person needs to know to make sure they are doing it correctly. Here are few of such things that you must know before filling out the 1099 reporting form.

Better to Give a Form Than to Get One

Business needs to send 1099 forms to all employees that made at least $600 a year with them. There are some exceptions and many people will get these forms even if they only made $10. It is better for the business.

There are Many Types of 1099 Forms

There are several types of 1099 reporting forms that are used including 1099 INT for income made from interest, the 1099 DIV for dividends, the 1099 G for unemployment related tax issues, and 1099 R for pensions and retirement accounts. The 1099 MISC is often given to independent contractors. These are just some of the forms that are used. Each form may look a little different and may need to be entered a little differently when the taxes are being done.

IRS Gets 1099

In addition to a person getting a 1099 form for their taxes the IRS will get a copy of this form as well. A person cannot hide this income. The IRS knows they are earning money and they might land up in a lot of trouble if they fail to report this income.

Address Changes

It does not matter if a person moves during the year as the IRS will get the 1099 form based on a person’s social security number and not their physical location. People need to update their address with the organization that is paying them to make sure they get the 1099 form on time. Moving and not receiving the form is not an acceptable excuse with the IRS.

All 1099 Forms Need to be Reported

A person needs to report all the income they receive on every 1099 form. The IRS will have a copy of every form and it is important that they match. These forms will be compared against a person’s tax return and if there is an error the IRS will catch it. If a person feels there is an error on the 1099 form they need to include the error and the explanation with the tax return. These 1099 forms cannot be ignored because the IRS will be paying attention to them. If a taxpayer does forget about their 1099 form the IRS will send them a letter and a bill for the amount of taxes that they owe.

1099 and State Taxes

The federal taxes are not the only ones that use the 1099 form. If this form is being reported to the federal government it is also being reported to the state. A person should not be surprised if they need to pay state taxes on the 1099 income as well.

These are some things people need to know about the IRS 1099 form. This form will show additional income that was earned during the year that needs to be reported to the IRS.

Comments are closed.