Things that will become expensive and cheaper are mentioned down there

GST impact is not hidden from us. From food to auto sector, Goods and Services Tax has affected almost every segment including automotive. Manufacturers of automobile parts in India will discuss how much GST will affect which segment across passenger, two-wheeler, and commercial vehicle categories.

It’s been months when GST was introduced in India by PM Narendra Modi, and people are still having a lot of confusion about the costing of the products after implementation of GST. Since it is now compulsory to levy GST on the goods and services, consumers don’t seem much happy at all. While the GST proposal is predicted to be beneficial, small cars won’t witness any big change in prices and luxury cars will get cheaper.

Let’s talk about impact of GST on two-wheelers, commercial vehicles, and passenger vehicles.

Two-wheelers

Two-wheelers are classified in two types – those with the engine capacity greater than 350 cc and those with less than 350 cc. A total of 30.2 % tax that has Excise Duty at 12.5%, NCCD at 1%, CST 2%, and VAT 12.5% makes the rate 30.2%. After GST implementation, two-wheelers under 350 CC would incur 28% tax. Two-wheelers with more than 350CC would incur 31% tax.

A Royal Enfield Classic 350 would cost less, but a Classic 500 would be more expensive.

Commercial Vehicles

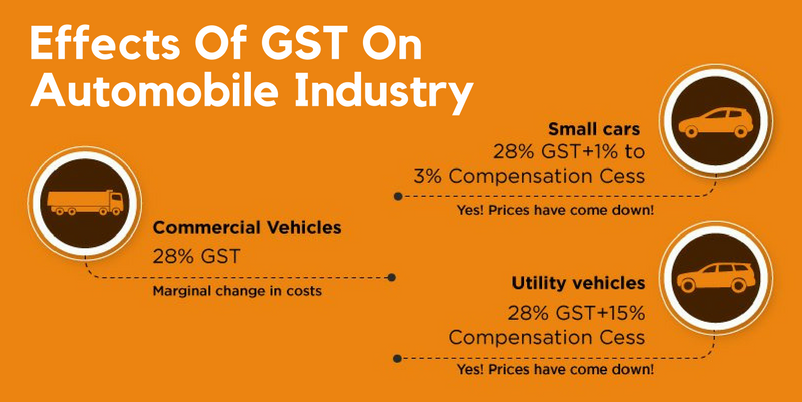

The commercial vehicle classification is done in two segments – commercial vehicles and three-wheelers. The tax structure before the introduction of GST for commercial vehicles includes 12.5% excise duty, 1% NCCD, 12.5% VAT and 2% CST made the total of 30.2%. NCCD was excluded for three-wheelers, which made 29.2% tax rate. After implementation of GST, new category for buses in which up to 13 passengers can travel would be introduced. Now the commercial vehicles’ new tax structure would be 28%. Three wheelers will have 28% tax rate and the new category of buses incurs new tax structure to 43% from 30.2%.

Passenger Vehicles

Passenger vehicles are segregated in most numbers based on length and engine capacity. Before GST, excise duty, NCCD, CST, infra cess, and VAT completed tax structure. After GST approval, there will be only GST and additional cess levied according to the vehicle segment.

While it is said that “one country one tax” is better for numerous segments, many contradictions have been made for the Government’s move of going green in terms of mobility solutions since it makes hybrid cars expensive. Manufacturers of hybrid cars find it harder to encourage potential buyers to purchase their products over their regular counterparts. Even automobile parts India have to make changes in their rate list after implementation of the GST.

Comments are closed.